Experience the perfect balance of performance and price with the new Mimosa C6x Lite Edition — built for today, ready for tomorrow.

As a founding member of the Broadband Access Coalition, Mimosa is proud to be a leader in the effort to extend quality broadband service to underserved areas of the United States, and to bring desperately needed competition to urban and suburban markets. We filed a petition with the FCC on June 21st, proposing that the 3.7 – 4.2GHz band be made available for point-to-multipoint services with low-cost licensing terms afforded under Part 101 rules. The good news is that the FCC published the petition for public comment on July 7th, a blisteringly fast 10 business days after we filed it (CG RM-11791).

https://ecfsapi.fcc.gov/file/1062353270786/17062202-1.pdf

Unfortunately, the mobile industry is quietly lobbying to secure the 3.7 – 4.2GHz band for its own exclusive use. And within 3 days of our petition being publicly noticed, FCC Commissioner O’Rielly posted a blog piece seemingly endorsing the reallocation of the 3.7 – 4.2GHz band for mobile services!

A Mid-Band Spectrum Win in the Making — By Michael O'Rielly

The stakes here could not be greater for both the fixed wireless industry, as well as for the consumers that ultimately have the most to lose. I hope that after reading this blog you will consider taking action and share your opinion with the FCC. If the giant cellular, chip, and equipment vendors have their way, we may lose our fastest and best opportunity to create a competitive broadband market in the United States. The corporate giants eyeing the 3.7GHz band are the very same companies who today have a virtual monopoly on home broadband services, and who have built LTE networks that make mobile data 100x more expensive per GB than what we pay for home broadband over cable or DSL.

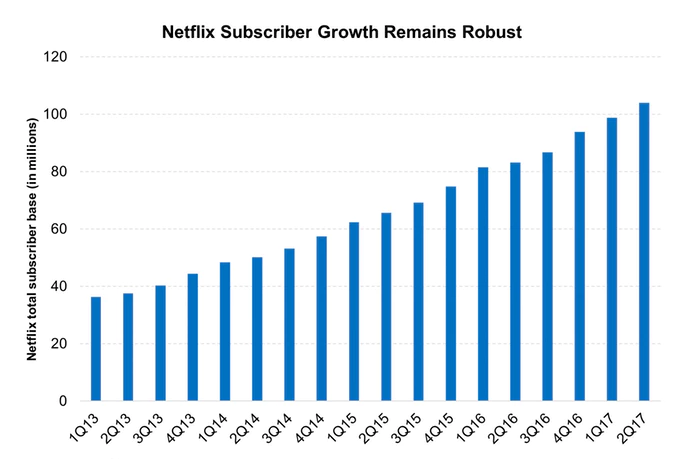

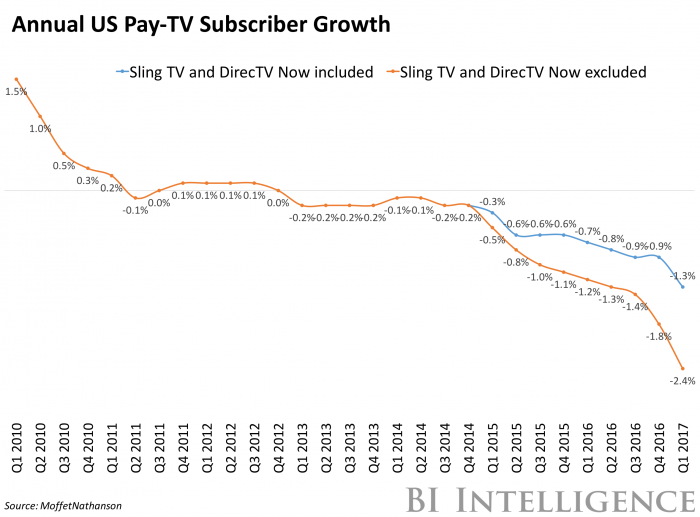

We’re quickly reaching a point where there will be one network traffic source that really matters in the world, and that’s the internet. Landline voice service became obsolete about five years ago, and traditional paid TV services are rapidly moving in the same direction. As evidence of this, “over-the-top” video revenues are growing 32% year-over-year, reaching an estimated $11.2B in 2017, according to Convergence Research Group. While far short of the $110B paid for traditional TV service, these revenues have stalled, and cable and satellite providers are struggling to prevent the inevitable decline in viewership. By the end of 2017, Convergence estimates that 25% of U.S. households won’t have traditional TV service. This trend is most apparent with young people, for example moving into their own apartment for the first time - they just want a fast internet connection, and they will figure out the rest on their own. As I’ve said to several operators recently, the most compelling service offering today is 100 Mbps/ 100 Mbps service for $50/month, without a contract obligation. As an industry, this is what we need to make possible for consumers.

Recent data from iGR Research tells us that American families consume 190GB/month, on average, over home broadband connections. Over 90% of the data consumption occurs over Wi-Fi within the home. Wi-Fi has become so synonymous with internet access that many people ask, “Is there good Wi-Fi available in this town?”. This was a head-scratcher for me when I first heard it. But then I realized that most people don’t think about the invisible plumbing of the internet. All they know is that their devices connect via Wi-Fi, so it seems like Wi-Fi service to them. With growing use of over-the-top video, iGR estimates that 95% of the download traffic is now video bits. With over-the-top revenues growing at 32% year-over-year, and consumers trending toward higher-resolution content, we can expect the average family data consumption to grow rapidly over the next decade. We need new networks to satisfy our growing data appetite, and hybrid fiber-wireless architectures operating over low-cost spectrum are the only cost effective networks in sight.

For those closely watching the debate, the FCC repeatedly uses the term “flexible use spectrum,” which essentially means making spectrum available in such a way as to allow service providers to decide whether to deploy mobile or fixed services at their discretion. This idea sounds reasonable on the surface, but the contrast between the economics of mobile and fixed services makes flexible use spectrum all but impossible in practice.

The Citizens Broadband Radio Service (CBRS) band is a perfect example. While that spectrum is theoretically available for anyone to deploy either fixed or mobile networks, the mobile companies are most likely and best poised to buy up the "priority area licenses" (PALs) in the most lucrative markets, at prices far out of the reach of average WISPs, and beyond what is supported by fixed service revenues. Most WISPs are resigned to the fact that CBRS spectrum will only be available in rural areas, and even then, there isn't enough spectrum to get the job done.

Someone recently asked me why the fixed wireless industry is even relevant, with unlimited LTE data plans becoming increasingly common? The simple answer is that “unlimited” data plans aren’t so unlimited, and the cost of delivering data over LTE networks is way too expensive for consumers’ home broadband appetite. The average price for mobile data in the United States is $6/GB, while the average price for fixed data is just $0.05/GB. With “unlimited” data plans hard-throttling customers at 22GB/month, and the average 4K movie consuming up to 14GB, it simply won’t be viable for most Americans to use LTE for their home broadband needs.

Why is LTE data so expensive? Because LTE networks are built using very expensive equipment and very expensive spectrum to facilitate non-line-of-sight communication to low-power devices moving at 70mph. Consider the recent AWS-3 spectrum auction as an example of the mobile economics. AT&T paid $18B to buy spectrum occupying a total of just 65MHz! The simple math tells us that with 132 million AT&T mobile subscribers, each one bears a “spectrum tax” of $136 as a result of that exorbitant auction price. What looks like a great revenue generator for the US Treasury is actually an invisible tax on consumers.

That’s not the case for fixed broadband access, however. The WISP industry operates very successfully in 580MHz of free 5GHz spectrum, and we’ve demonstrated as much by deploying very low-cost WISP networks nationwide. To continue its expansion, however, we need to build hybrid-fiber-wireless networks that can deliver 100Mbps speeds at $50/month. To do that, our industry desperately needs the 3.7 – 4.2GHz spectrum on favorable economic terms, and the equipment needs to be much more cost effective than LTE gear, including small cells.

Looking in further detail at the math, a consumer paying $50/month for internet access generates $600/year in service revenue. In order for that service to be a healthy business, without government subsidies and without long-term service contracts, a service provider cannot afford to invest more than about 1x annual revenue in the capital necessary to support the subscriber. From our experience at Mimosa, service providers spend about $250 at the subscriber premises, and about $250 northbound to the internet. That doesn’t leave much room for licensed spectrum cost. In the current WISP world, spectrum costs are zero when operating in the 5 GHz band. For those WISPs using Part 101 backhaul radios, fees are about $1k per site, and those carry a 10-year license with an auto-renewal. Being sensitive to the spectrum cost, we proposed in the 3.7 GHz petition that the access point should carry the $1k per site license fee, but that the subscriber radios be “pre-coordinated” and avoid the cost and time of a separate application process. If the access point carries 25 subscribers, as an example, the “spectrum tax” per subscriber is $40. The “pay-as-you-go” system under Part 101 is ideal for smaller competitive service providers because the upfront investment is simply $1k per access point site. We believe this is ideal to stimulate competition, and the math makes it possible for an upstart service provider to quickly make money.

The auctioned spectrum model simply does not work for small to mid-sized service operators. In the AWS-3 auction, four major players paid $41B for 65 MHz of spectrum. If an incentive auction occurs for the 500 MHz of spectrum in the 3.7 GHz band, we can imagine numbers being of similar magnitude. While 3.7 GHz is not nearly as attractive as the AWS-3 spectrum, there’s almost 8x the amount of spectrum at stake. Consider the wherewithal of the smaller operators to play in this game. The largest WISP in the United States is Rise Broadband, based in Englewood, Colorado. With 200k subscribers and $150M in revenue, Rise has grown through the acquisition of several smaller service providers. Rise’s total capitalization is less than the smallest bidder in the AWS-3 auction. Quoting the company website, “The company likens its strategy to a doughnut, with large wireless service providers such as AT&T, Comcast, Verizon and others focusing on large urban areas. In contrast, Rise focuses its resources on suburban and rural areas ‘where the capabilities of its larger competitors diminish.’” Opening the 3.7 GHz band for shared use under Part 101 rules would enable companies like Rise to compete for the doughnut hole, rather than forever being relegated to the doughnut where the big guys don’t want to play. Auctioning the 3.7 GHz band would have the opposite effect, securing the position of the major players by virtue of the fact that they have the billions of dollars necessary to buy nationwide spectrum. Once they own this national asset, they will use it for mobile services, dictated by the economic realities of mobile versus fixed pricing, and we lose our opportunity to create a competitive broadband market in the U.S.

I hope you’ll agree with us here at Mimosa: Now is the time to act. Let the FCC know what you think – whether you’re a consumer, a network operator, or a peer vendor in the space. We have a unique opportunity to build and enjoy the broadband network of the future, but we need the FCC – and you – to help us make it happen.

Please read more about our proposal and take a few minutes to speak your mind:

If you’re representing a business or other institution, you can file regular comments by entering RM-11791 here:

https://www.fcc.gov/ecfs/filings

If you’re an individual who wants to file express comments, enter RM-11791 here:

https://www.fcc.gov/ecfs/filings/express